If you are running a business, Google Ads is an excellent way to reach your target audience and divert traffic to your website. However, invoicing can be a daunting and confusing task. It's important to understand how it works and what you need to do to manage it effectively.

This blog post will cover everything you need to know about Google Ads invoicing. From the basics of what a Google Ads invoice is, how to download it, and how to read it, to common issues that users face and how to overcome them. After reading this guide, you'll have all the knowledge necessary for managing your Google Ads invoicing like a pro. So sit back, relax, and let's dive into the world of Google Ads invoicing!

Table of Contents

6. Understanding Your Google Ads Invoice

7. Common Issues with Google Ads Invoicing

What is a Google Ads Invoice?

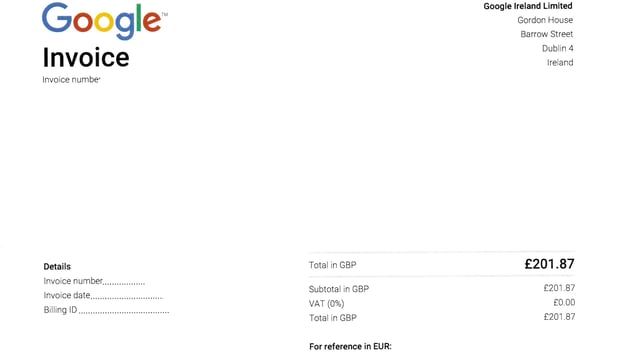

A Google Ads invoice is a document that displays the total cost of advertising, including campaign expenses and outstanding balances. It is created either at the end of each billing cycle or upon reaching a spending threshold. The invoice can be accessed and downloaded from the "Billing & Payments" section of your Google Ads account.

Differences Between AdWords & Google Ads Invoicing

In 2018, AdWords invoicing was replaced by Google Ads invoicing which offers more control over billing and payments. With this feature, you can set up multiple payment methods and select your preferred billing cycle.

The invoices are comprehensive with detailed information on ad spend, taxes, and fees. Accessing and managing the invoices is convenient as they are available on your Google Ads account. To make payments, all you need to do is log in to your account using a variety of payment options like credit card or bank transfer.

Billing settings Overview

To effectively manage your Google Ads account and keep track of your ad spending, it's essential to understand the available billing options. Google Ads offers automatic and manual payment options along with setting up a payment threshold. Automatic payments are regularly deducted from the preferred choice of payment method while manual gives you control over paying when you wish to do so.

The Payment threshold option allows advertisers to set a spending limit after which Google automatically charges their chosen method of payment. With access to detailed monthly invoicing reports on the billing summary page, tracking expenses has never been more manageable.

Payment & Billing Thresholds

To make the most of Google Ads invoicing for your business needs beyond just google ads invoice requirements, it's important to understand payment and billing thresholds. Keep in mind that there are different payment options available such as manual payments and automatic payments.

Do familiarize yourself with the billing thresholds – which is the amount you need to spend before your account is charged. You can also set up automatic payments for avoiding campaign disruptions due to missed payments. Make sure you track spending & invoices regularly.

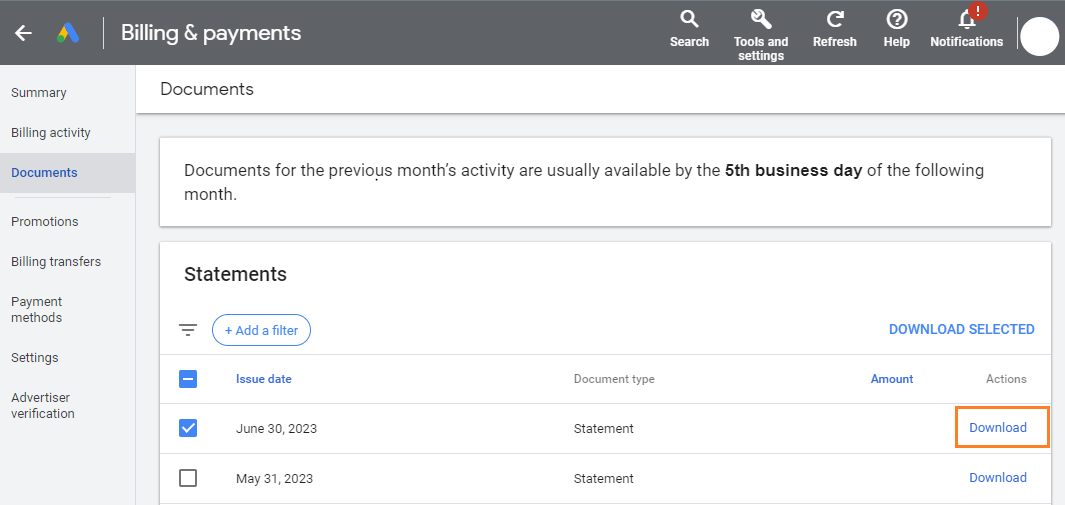

How to Download Google Ads Invoice (PDF)?

To download your Google Ads invoice as a PDF, go to the "Billing & payments" section of your account settings and select "Transactions" followed by "Invoices." Look for the desired invoice and click on the PDF icon. It's a straightforward process that can be completed in just a few clicks.

Understanding Your Google Ads Invoice

To effectively manage your billing, it's vital to understand your Google Ads invoice. You have multiple payment options available, including credit card, bank transfer, and automatic payments. Reviewing each invoice's billing details ensures accuracy in the amount due, payment due date, and account information.

To stay informed about payments, set up billing alerts while keeping an eye out for discounts or promotions that could save you money on future campaigns.

Common Issues with Google Ads Invoicing

Inaccurate billing is one of the most common issues faced by advertisers who use Google Ads invoicing. This happens when discrepancies arise between the amount owed and the amount charged by Google Ads.

Payment issues can also crop up when using credit cards or PayPal as payment methods. One way to resolve this is by disputing them through the Google Ads platform. Keeping track of billing cycles and deadlines will help you avoid late payments and account suspension.

VAT on Google Ads Invoicing

Businesses using Google Ads must understand the role of VAT (Value-Added Tax) in invoicing. VAT rates vary by country, and businesses should be aware of local regulations. They may be eligible to claim back VAT on their Google Ads expenses, depending on their location's rules.

The invoicing options available for businesses are determined by their VAT status and requirements. Incorporating VAT in your bookkeeping process is essential for accurate accounting purposes.

Bookkeeping with Google Ads Invoices

To maintain accurate accounting records for your business using Google Ads Invoicing services, there are several steps you should follow. First and foremost, it is crucial to understand the various types of invoicing and payment options available.

In addition to this, keeping an accurate record of all your business-related expenses will help you manage your bookkeeping more efficiently. Setting up automatic payments and monitoring your billing thresholds is also critical in avoiding unnecessary charges. Finally, reviewing your monthly invoices for accuracy and resolving discrepancies promptly is essential.

Related Resources

Looking for more information on how to manage your Google Ads account and handle its associated invoicing process efficiently? Our comprehensive guide covers everything from setting up billing preferences to understanding payment methods and troubleshooting common invoicing issues.

Additionally, we provide resources like Google Ads Help Center and support forums to help you optimize your ad campaigns better. Trust us when it comes to managing your Google Ads invoices.

Conclusion

Google Ads invoicing can be a tricky process to navigate, but with the right information and resources, it can be simplified. Understanding the differences between AdWords and Google Ads invoicing, billing settings, payment thresholds, VAT, and bookkeeping is crucial to ensure smooth transactions.

Our ultimate guide to Google Ads invoicing covers everything you need to know in detail. If you have any further questions or concerns about Google Ads invoicing, check out our related resources section for more information. For more personalized assistance and expert support, contact us.